FY2026 Budget

The City of Pooler is pleased to announce the release of the proposed Fiscal Year 2026 Budget for public inspection. The proposed budget is available at the link below, as well as in person at City Hall, located at 100 US Highway 80 SW, Pooler, Georgia, 31322, during normal business hours (9:00 a.m. – 5:00 p.m., Monday through Friday). We encourage residents to submit comments via email, in writing to the Finance Department, or in person during our upcoming public hearings:

- Monday, November 3, 2025 at 6:00 p.m. (First reading of the budget will follow)

- Monday, November 17, 2025 at 6:00 p.m. (Second reading/final adoption of the budget will follow)

Both hearings will take place at Pooler City Hall, and we invite all interested residents to participate. For the proposed FY2026 Budget and Budget Workshop slides, please visit the links below.

Q&A

Does the Greenspace allocation represent funds available to purchase additional land for preservation?

Yes, the proposed greenspace allocation of $250,000 would be for funds to purchase additional land for preservation.

How much greenspace in the form of recreation space does the City currently own?

The City currently owns over 200 acres of recreation space. These funds represent potential opportunities to secure and preserve additional green space for public use and environmental protection.

Pooler Recreation Complex at 200 Preston Stokes Drive (PIN # 51013 01048) – 87.12 acres

Pooler Recreation Park at 900 S. Rogers Street (PIN # 50009 01019) – 126.72 acres

Please clarify the investment in Public Safety? Is it 3.2M or 3.8M?

The recommendation to support Public Safety is a total of $3.8M. The recommendation is supported by $2M allocation in SPLOST 8 (if approved) and $1.8M allocation from the FY 2026 general fund.

What is planned for drainage improvements, and will an environmentalist be involved in the process?

The $500,000 allocated for drainage improvements will fund hydrological and hydraulic modeling of the City’s drainage basins. This effort will help identify needed upgrades and improvements. An environmentalist will not be directly involved in the modeling effort.

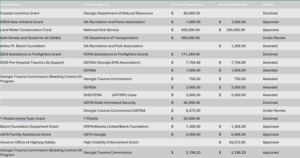

Has the City been submitting grants without hiring a technical writer?

Yes. The City has been preparing and submitting its own grant applications without the use of a hired technical writer. Technical writers are not required for grants, but they’re often highly beneficial, especially for competitive or complex grant proposals. The City of Pooler has applied for 18 grants in FY 2025 using the expertise of our current staff noting again that technical writers are not always required for grants. However, to pursue additional grants we are proposing an allocation to support third part professional grant writing.

See the status of grants applied for in FY 2025, noting that the City has successfully secured over 60% (12/18) of all grant applications submitted.

Can you clarify “Modernized, Family-Friendly Parks & Recreation Planning”?

This funding would support equipment replacement for playground equipment for any of the parks in the City. Ultimately, the funding is intended to enhance the City’s parks and recreation system to ensure facilities are modern, accessible, and family-oriented. The funding level reflects the comprehensive scope of this planning effort.

Does the DDA (Downtown Development Authority) funding include salaries, and what will these funds support

Yes, the funding would support the establishment and operations of a Downtown Development Authority, including the salary of an Executive Director, as determined by the DDA Board. These funds are intended to help launch and sustain the DDA’s work in economic development and downtown revitalization.

What is the $100,000 allocation for “Implementation of Councils/Committees”?

This funding is set aside to help establish volunteer councils or committees, including potential costs for materials, supplies, or administrative support. Any unused funds will be reallocated back to the general fund. The recommendation was made in support of a Youth Council and/or Senior Councils, acknowledging that the formation of specific councils/committees, remains at the discretion of Council based on identified needs and priorities.

Where are City bids shown?

All bids are publicly posted on the City of Pooler’s official website as well as on the Georgia Procurement Registry to ensure full transparency and accessibility.

Why can’t the City just issue more traffic citations to raise revenue?

Ultimately, such a targeted approach is illegal, unsustainable, and bad public policy, and Georgia is already acting to stop it. Georgia law, to include pending legislation specifically HB 140, the “End Local Taxation by Citation Act”, limit and scrutinize the use of fines as a revenue source, state agencies can revoke enforcement privileges when abuse is found, and relying on ticketing as a budget strategy is ethically problematic and invites audits, legal action, and loss of public trust. Public safety remains a top priority for the City, and the Police Department will continue to enforce all laws and issue traffic citations where appropriate.

What does the $1.5 million for public safety include?

Is $250,000 on greenspace adequate?

The $250,000 greenspace allotment is designed as a cumulative fund. Year over year investments into this initiative would allow for these funds to accumulate, allowing for larger future purchases. For example, $250,000 per year over four years would total $1 million, which could be used to acquire a property solely for greenspace preservation

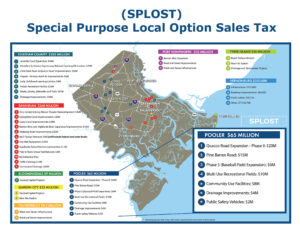

Can the City redistribute SPLOST allocations to the General Fund?

No. By law, SPLOST (Special Purpose Local Option Sales Tax) funds cannot be specifically “redistributed” to the City’s General Fund. SPLOST revenue must be used exclusively for voter-approved capital projects, as outlined in the intergovernmental agreement and referendum language. For example, the current SPLOST for the City of Pooler totals approximately $65 million over six years (about $10 million per year). If the City were to replace SPLOST funding with General Fund revenue to cover those same capital needs, it would require increasing the millage rate from approximately 4.197 mils to 7.3 mils — a 74% increase — to generate equivalent funding.

How is the Chamber funded?

That is a question for the Chamber. The Pooler Chamber of Commerce is a private-sector, non-profit organization incorporated under the laws of the State of Georgia. It operates independently from the City and is not funded through City tax revenues.

Who approves pay raises for city employees?

In accordance with the City of Pooler’s Charter, the Mayor and City Council approve the budget, which includes any pay raises, merit raises and/or cost of living allowances.

What efficiencies has the City implemented in FY 2025 to help reduce costs?

In FY 2025, the City established a targeted efficiency goal of $445,000. As of October 1, 2025, through a combination of contract adjustments and operational changes, the City exceeded that goal, realizing total estimated savings of $455,600 so far in FY 2025. These savings were achieved without impacting levels of service.

What is the accommodations excise tax as referenced on page 14 of the budget, and how is it regulated under Georgia law?

The accommodations excise tax, commonly referred to as the hotel/motel tax, is a 6% tax the City of Pooler collects on rooms or lodging provided to the public by hotels and similar businesses. Under O.C.G.A. § 48-13-51, the City must use 33.3% of the revenue to promote tourism, conventions, and trade shows through a qualified nonprofit organization, known as a destination marketing organization (DMO). These funds are restricted by state law.

What data or models support the 9.4% increase in the property tax digest for 2026, and what contingency plans exist if actual growth is lower (e.g., due to economic slowdown)?

The 9.4% increase in the property tax digest is based on data provided by the Chatham County Board of Assessors and multi-year trends in Pooler’s residential and commercial growth. Specifically, the city’s 2025 net digest was $3,036,437,065. Based on our five-year history, increases in the digest from reassessments of existing real property are expected to be 4.24%, and increases in other changes (including new growth) are expected to be 5.14%. Generally, property taxes are more stable compared to sales tax revenue during a slowdown in the local economy. Local economists believe that any slowdown in the area’s economy will be temporary. Again, the projection reflects new construction, redevelopment, and continued market appreciation. If actual growth is lower than anticipated, the City will delay nonessential capital purchases and limit discretionary spending to maintain a balanced budget without impacting core services.

Why is Local Option Sales Tax (LOST) projected to decline by 2% compared to 2025 actuals, and how sensitive is the budget to further declines in consumer spending?

The FY 2026 projection includes a conservative 2% decline from 2025 actuals to account for adjustment based on the Intergovernmental agreement that was signed in 2022. To be more specific, sales tax revenue is affected by an intergovernmental agreement negotiated in 2022. The agreement allows for a gradual increase in the County allocation of the sales tax from 25% to 31%, resulting in a reduction of sales tax revenue to the municipalities. In 2025, the reduction to the municipalities was 2%. Sales tax revenue during the first quarter of 2025 was down 5.02% compared to the first quarter of 2024. As of September 30th, sales tax revenue was down 1.52% compared to the same nine months in 2024. The final increase of 3% occurs in 2026. Flat to modest growth in sales tax revenue is not expected to overcome the reduction in sales tax revenue in 2026. Sales tax revenue is closely monitored, and corrective measures will be taken to mitigate the city’s exposure to significant decreases in collections. Staff monitor collections monthly and can adjust operating expenditures midyear if necessary.

In the SPLOST Fund, with $28.0 million in remaining commitments (e.g., $18.7M for Quacco Road widening), what is the timeline for completion, and how will any cost overruns be funded?

The City’s major SPLOST commitments include $18.7 million for the Quacco Road widening project and $9.3 million for other transportation and infrastructure priorities. Construction on Quacco Road Phase I is projected through 2027. Any cost overruns would be addressed through project reprioritization within available SPLOST funds.

Why is there a $3.3 million transfer from the General Fund to the Local Resources Capital Projects Fund, and can you break down the $1.9 million in public safety vehicles by department?

The $3.3 million transfer supports capital needs not funded by existing SPLOST funding. Of this amount, $1.9 million funds public safety vehicles, including approximately 26 police units (refer to question 4 for the types of vehicles) for the Pooler Police Department. These investments maintain fleet readiness and support Pooler’s growing public safety demands. Other costs associated with this tranfer include other heavy equipment and road paving projects to support Public Works.

For the Accommodation Excise Tax Fund, how will the $1.5 million transfer to tourism/general fund be used specifically, and what metrics track tourism ROI?

The accommodations excise tax, commonly referred to as the hotel/motel tax, is a 6% tax the City of Pooler collects on rooms or lodging provided to the public by hotels and similar businesses. Under O.C.G.A. § 48-13-51, the City must use 33.3% of the revenue to promote tourism, conventions, and trade shows through a qualified nonprofit organization, known as a destination marketing organization (DMO). These funds are restricted by state law. Ultimately, in accordance with state law, the $1.5 million transfer supports tourism promotion, event programming, and marketing efforts that enhance Pooler’s visitor economy. The City monitors the accommodation excise tax through metrics such as hotel occupancy rates, local sales tax performance, and event attendance, but largely this is an effort of Visit Pooler the City’s destination marketing organization (DMO). Again, this is a better question for the Chamber, noting that the City of Pooler is state mandated to provide 33.3% of the accommodation excise tax to a DMO. See the state statute for additional details O.C.G.A. § 48-13-51

What are the expected outcomes and staffing needs for the new Communications Department ($0.2M in General Government)?

The new Communications Department, established in FY 2025, will strengthen public information, social media presence, and community outreach. The FY 2026 allocation funds ongoing operations, including staffing for a Communications Coordinator, media tools, and training. Outcomes include improved transparency, consistent messaging, and expanded resident engagement.

So far in FY 2025 the City has launched its first social media campaign with a presence on Facebook, X, and Instagram which occurred in July 2025. In addition, the City has created more video content regarding the capital projects and grants won in the City. The next efforts will continue engagement and communication efforts across our various platforms to include our website.

There are currently no additional staffing needs in this regard.

For the $0.2 million appropriation to start a Downtown Development Authority (DDA), what are the initial goals, board structure, and how will it integrate with existing planning/zoning efforts?

The DDA funding supports organizational start-up, legal formation, and initial planning or branding activities. The DDA will have a seven-member board appointed by City Council and will focus on downtown revitalization, business recruitment, and coordination with Planning and Zoning to support mixed-use development and economic vitality. Ultimately, the goal is to move forward with the previously approved mainstreet master plan.

This plan provides an opportunity to establish clear, achievable goals that will guide the continued growth and revitalization of the historic Main Street. The master plan will serve as a roadmap to:

• Build upon the area’s history, assets, and recent development momentum;

• Attract new businesses, jobs, and visitors to Main Street;

• Recommend enhancements and promote high-quality design and development along the corridor.

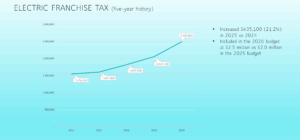

How were the increases in electric franchise taxes ($2.5M) and insurance premium taxes ($2.5M) estimated, and what external factors (e.g., utility rates or insurance market trends) could impact these?

Both estimates are derived from multi-year collection averages and/or recent utility and insurance trends in Pooler. Factors such as changes in utility rates, regional energy consumption, population growth, and state insurance premium distributions can affect revenues. Staff continually review state remittance reports and local indicators to adjust projections as needed.

The 2025 electric franchise tax revenue was $2,490,000. The five-year history of this revenue indicates an average percentage increase year-over-year of 12.20%. Utility rates are frozen until 2028. Significant increases in this revenue source are directly related to development. See trend below for reference.

The 2025 insurance premium tax revenue was $2,786,000. The five-year history of this revenue indicates an average percentage increase year-over-year of 16.33%. This tax is based on gross premiums collected by insurance companies and is also affected by development. See trend below for reference.

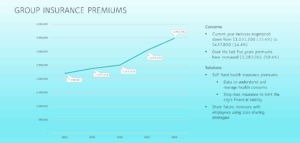

What justifies the 15.3% increase in group health insurance premiums ($0.5M), and are there efforts to mitigate future rises (e.g., wellness programs or alternative providers)?

The increase reflects market-wide premium adjustments and utilization trends. The City continues to explore strategies to manage costs, including employee wellness initiatives, preventive care programs, and periodic reviews of alternative providers and plan designs to ensure affordability and value. Ultimately, the goal would be for the City to become self-funded as a means to control the costs, but currently we can only bid group insurance to carriers such as Anthem, Cigna and Aetna. We bid it competitively year over year, but the market-wide premiums continue to increase. See trends and potential solutions as noted below:

The city managers number in the budget, the 450k+/- , is that the budget for his/her position or is it their salary for the year?

No, this is not the City Manager’s annual salary. The $439,145 budgeted under City Manager is the total for the City Manager’s office, not just the City Manager’s salary. It includes salary, wages and benefits for both the City Manager and an administrative assistant. The budget for the City Manager’s Office also covers $20,000 for purchased and contracted services and $12,000 for general supplies and materials. In addition, the budget has allocations for travel, education, training etc. for the City Manager and the administrative assistant.

When it comes down to the police department budget, what exactly is under the 1.5m for consumables? I know ammo and fuel are a big one, but what else?

The $1,526,000 for public safety supplies covers general supplies and materials for BOTH the police and fire departments. For the police, this includes $642,000 for items such as ammunition, fuel, electricity, small equipment, and other day-to-day operational supplies. While ammunition and fuel are significant costs, the funds also support general operational needs.

What is the general estimate that the city is looking to spend on each new police vehicle? Is there a particular make and model the Chief is looking into? What's the time frame?

The city plans to purchase 21 Ford Interceptor SUVs outfitted with lights and safety equipment estimated at approximately $74,500 each. Additionally, 4 Ford Interceptor SUVs for the Criminal Investigations Division at $59,000 each and 1 Ford Expedition for CID at $70,000. These purchases are planned as part of FY 2026 budget and would be purchased in FY 2026, pending availability.

Does this plan include salary increases for City of Pooler employees?

Yes, the plan includes a 2.25% cost-of-living adjustment (COLA) for all employees, along with potential performance/merit increases based on performance evaluations.

How does the FY 2026 budget align with SPLOST 8 recommendations?

The FY 2026 budget aligns with SPLOST 8 requests. The City of Pooler’s Proposed FY2026 Budget focuses on continuing key infrastructure improvements, including roads and drainage, and reflects ongoing commitments within the SPLOST Fund for major transportation projects such as Quacco Road, Pine Barren Road, and Benton Boulevard. The City’s SPLOST 8 proposal aligns with these same priorities namely Public Safety, Roads, Drainage, Recreation, and Civic Investments, demonstrating consistency between the FY2026 Budget and Pooler’s long-term capital investment goals.

Did Mayor and Council exceed their allotted travel budget for FY 2025”?

No, as of 10/ 30/2025, the allotted travel budget has not been exceeded. In addition, there is not a planned increase in the FY 2026 budget for travel for the Mayor and Council.

Did Mayor and Council exceed their allotted training and education budget for FY 2025”?

No, as of 10/30/2025, the allotted training and education budget has not been exceeded. In addition, there is not a planned increase in the FY 2026 budget for training and education for the Mayor and Council.

How was the Pipemakers Canal Improvement Funded?

The Pipermakers Canal Improvement has been completed and was funded by SPLOST 7

How much funding is anticipated to support drainage in the City?

See proposed funding allocations below to support drainage in the City:

- General Fund proposed allocation FY 2026 proposed – $500,000

- SPLOST 8 – $4M proposed allocation

- 4250 – Storm Drainage – $1,669,525

- 4251 – Canal Maintenance – $451,620

See excerpt below from the proposed FY 2026 budget (page 7) and SPLOST 8

How was the “2027 & Beyond” scoring determined for the Long-Term Council Priorities?

The numbering in the presentation does not represent the importance of any specific project. These long-term priorities were developed by City Council during the past two retreats as part of our proactive planning effort for Pooler’s future, hence the “2027 and Beyond” designation. The information was used to gauge which items Council viewed as more pressing as we plan ahead. This effort was a part of the retreat conducted on Monday Sept 15th. The minutes to the retreat were previously posted and can be found at the following link:

Are the budget numbers presented at the budget workshop the final amounts being proposed?

No. The figures shared during the workshop were preliminary and intended for discussion purposes. Since that time, the City has made capital and efficiency reductions, and the final proposed budget reflects those adjustments.

See below as referenced in page 4 of the proposed FY 2026 budget for the final proposed funding.

Were council members promised any benefits in relation to the establishment of the DDA?

There is no record or indication that any council members were promised benefits in connection with the DDA. Pursuant to O.C.G.A. § 36-42, all DDA activities are subject to oversight and audit by the Georgia Department of Community Affairs to ensure compliance and transparency.

Are DDA board members or directors compensated for their service?

No. Under O.C.G.A. § 36-42-7, board members serve in a voluntary capacity and receive no compensation for their role. Their service is civic in nature and intended to promote public benefit.

Why does the DDA have a paid position, unlike the planning and zoning board, despite the planning board also being volunteer?

It is currently being proposed that the DDA have funding to support a paid position to manage the operational needs of the authority, including administration, legal support, and program oversight. The position is recommended to ensure accountability and focus on successful implementation of the Mainstreet master plan. It is not legally required to have an executive director; hence the state statute does not require an executive director position.

What changed in the budget from $80,000 to $200,000, and can the money be reassigned?

The initial recommendation was for $120,000, the change reflects the inclusion of resources to support training, administrative needs if the DDA is established, including materials and supplies, as well as potential funding for an executive director and/or legal counsel if determined to be required. It should be noted that the existing Development Authority does retain a legal attorney. Training for the directors is required per O.C.G.A. § 36-42. Yes, the proposed funds can be reassigned or reallocated if not used.

Will the creation of the DDA affect the Chamber of Commerce or its funding?

No. The establishment of a DDA operates independently of the Chamber and should not impact the Chamber’s funding or activities.

What are the measurable goals or benefits during the DDA’s first year?

In accordance with O.C.G.A. § 36-42, measurable goals cannot be established until the DDA is formally created by resolution of the governing body. Until that time, the Authority has no legal capacity to conduct business or implement projects and thereby there is not currently any measurable goals or a 1 year action plan. Such plan would be determined by the board established by the resolution.

Does the City of Pooler plan to redirect hotel/motel tax funds currently managed by the Greater Pooler Area Chamber of Commerce and Visitors Bureau to the Downtown Development Authority (DDA)?

No. State law prohibits redirecting hotel/motel tax funds currently received by the Greater Pooler Area Chamber of Commerce and Visitors Bureau (specifically Visit Pooler) to any other entity, including the Downtown Development Authority. The City has neither the authority nor any intention to take or redirect these tourism funds. By law, they are restricted solely for tourism-related purposes as referenced in O.C.G.A. § 48-13-51

Can you explain the new line item in the budget for “communications” at a budget of 160,125?

The Communications Coordinator position was first budgeted in FY 2025, and in FY 2026, following the onboarding of the position, it was determined that Communications should be identified as a separate department within the budget to better reflect its growing scope and importance.

Approximately 70% of the total budget, covers salary and benefits associated with the Communications Coordinator position, which manages all communication responsibilities for the City as a one-person department. The remaining 30% of the budgeted funds are for operating expenses such as fees for the necessary communications programs, camera equipment, and sound equipment, as well as software, professional memberships, training, licensing, advertising, and other supplies.

See page 4 from the FY 2025 budget or reference.

Can you provide more details on the $1.9 million allocation for police vehicle updates, including the number of vehicles, models, and rationale for the timing?

The $1.9 million allocation funds replacement AND outfitting (whereas outfitting refers to the process of equipping a newly purchased vehicle with the specialized tools, technology, and safety equipment required for law enforcement use) of approximately 21 patrol and 5 specialty vehicles, including SUVs and pursuit-rated sedans. The majority of the vehicles being replaced and outfitted are Ford Interceptor SUVs. The timing aligns with the City’s need to begin replacing a fleet that has exceeded the useful lifetime, noting that the vehicles being replaced are nearly 10 years old. The timing coincides with our effort to maintain reliability, reduce maintenance costs, and ensure officer safety, noting again that all of the vehicles being replaced are 2016 and older. The update supports operational readiness and reflects the City’s commitment to maintaining a modern, dependable fleet for our public safety personnel.

What specific projects or initiatives are covered under the $0.5 million for drainage modeling in Public Works, and how will success be measured?

This funding supports citywide hydrologic and hydraulic modeling to evaluate system capacity, identify deficiencies, and prioritize future stormwater improvements. Success will be measured through completion of the model, identification of key project areas, and improved data-driven planning for SPLOST and grant-funded infrastructure projects.

For Recreation and Parks, how will the $0.2 million for city-sponsored community events and $0.3 million for green space purchase/protection be prioritized and allocated?

- Community Events ($0.2M): Funding will expand city-hosted events such as seasonal celebrations like a Fourth of July event (as an example only), and/or family programs like a city-wide Trunk or Treat (as an example only) to strengthen community connections.

- Green Space ($0.3M): Funds will support acquisition or protection of key parcels for passive recreation and environmental preservation. Prioritization will be based on accessibility, connectivity, and alignment with the City’s comprehensive plan.

Given the $3.9 million use of fund balance in the General Fund, what is the projected ending fund balance, and what policy governs minimum reserves?

The FY 2026 budget includes a planned $3.9 million use of fund balance for one-time capital projects. The projected ending balance remains above the City’s preferred minimum of annual operating expenditures, ensuring sufficient reserves for emergencies and revenue fluctuations.

How does the budget address ongoing inflation concerns, particularly if the rate exceeds the assumed 2.9% or unevenly affects supplies/purchased services?

The budget incorporates a 2.9% inflation assumption, with modest contingencies built into departmental budgets for fuel, utilities, and contracts. If inflation outpaces projections, the City will adjust spending priorities and defer nonessential purchases to maintain service levels and budgetary balance.

How will the $0.1 million for grant writing services be evaluated for effectiveness, and what types of grants (e.g., federal infrastructure) are targeted?

This allocation funds professional support to pursue competitive grants in areas such as infrastructure, transportation, public safety, and stormwater improvements. Effectiveness will be evaluated based on the number of applications submitted, total funding secured, and alignment with the City’s long-term capital improvement priorities.

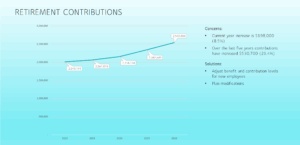

Are there plans to address the 8.4% increase in retirement contributions ($0.2M), such as pension reforms or alternative retirement options?

Yes, we are actively investigating actions to address the increase. The increase reflects actuarial adjustments within the Georgia Municipal Employees Benefit System (GMEBS). The City routinely reviews the plan’s long-term sustainability and will consider potential reforms such as tiered benefits or supplemental defined-contribution options to maintain affordability and stability. See trend below and note again potential solutions for consideration.

Is there anything in the budget to add lights to my neighborhood? Rothwell st area

The current budget does not specifically include funds for new streetlights on Rothwell Street. Any additions to lighting would need to be evaluated and prioritized through the city’s public works or capital improvements process.

There are a few locations on chestnut st that have been acquired by the city. I've heard rumors about a possible new police department. Can you verify this?

At this time, there are no confirmed plans to construct a new police department on Chestnut Street. No project has been identified or funded in the FY 2026 budget for the repurposing of the properties along Chestnut recently acquired by the City. Any future decisions about facilities would be included in upcoming budget proposals.